The Playbook by SMBootcamp

Greetings, searchers!

Last week, we shared Drew Eckman’s first two of five ways to help lenders fall in love with your deal: 1) Underwrite Cash Flow Like a Lender and 2) Include Sensible, Provable Addbacks Only.

Drew leads our SMB Loan Support brokerage service and helps self-funded searchers prepare lender-ready financing packages. These next three tips come directly from what he sees lenders prioritize when evaluating deals.

Today, we’re sharing Drew’s final three ways that close SBA deals: 3) Position Yourself as the Perfect Buyer, 4) Show the Cushion: Working Capital + Post-Closing Liquidity, and 5) Address Key Risks in Your Deal Head-On.

Enter Drew below.

Tip #3: Position Yourself as the Perfect Buyer

Every lender’s dream is a buyer who has spent twenty years doing exactly what the target company does in the same industry. But the reality is that most of the individuals we work with at SMB Loan Support have no direct industry experience. That’s OK.

What matters is whether you can make a strong, credible case that your background aligns with what the business actually needs on Day 1. Our best clients are passionate about how their experience lines up with the target. The stronger the story, the more attractive the deal. So how do you position yourself best to have that strong story?

Start by mapping the responsibilities of the owner you’re replacing. What does the owner do every week? Who does he manage? What decisions land on his desk?

Then define the business model. Is it a consumer marketing business at its core (with B2C lead gen, reviews, scheduling, etc.)? Is it a business with B2B sales / account management? A manufacturing business that lives or dies based on scheduling, quality control, and operations management? When you know the job, you can start to build a compelling case to lenders as to why you’re the perfect person for it.

I can tell you this: simply understanding finance and deciding an industry is “hot” (looking at you, HVAC), doesn’t make you the ideal person for it.

Here's a quick example from a former client. He left a corporate role in HR services and technology to buy a residential HVAC business. On paper, he had zero industry experience. He’d never turned a wrench. But in practice he was a perfect fit for this business. He was data-savvy, having worked on a variety of digital transformation initiatives over his career. He had built, grown, and managed large teams. He’d owned budgets and driven P&L results. And importantly, he’d grown up in a blue-collar family and worked residential construction – so he was ready to get in a crawl space.

Residential HVAC, at its core, is a consumer marketing business powered by a blue-collar workforce. He brought the digital transformation experience, operational experience, and leadership experience techs would follow. This made him an ideal buyer that lenders saw as a credible operator, despite never having worked in the HVAC industry before.

So here’s what lenders want to see, and how you can show it:

Map out the owner’s responsibilities. Be able to say: “Here’s what the seller does, and here’s my experience that covers each item.” If there are gaps, present a strong plan for how you’re addressing those gaps.

Demonstrate leadership / management experience. You don’t need to have run a 100+ person org to get an SBA loan. But you do need real examples of leading people and owning outcomes.

What’s your angle? You should be able to describe the business and how it makes money, serves customers, and wins. What is it about your background that fits that business?

You don’t need direct industry experience to position yourself as the perfect buyer. But if your sole positioning is “I’m smart, I’ll figure it out,” that isn’t a great strategy.

Tip #4: Show the Cushion: Working Capital + Post-Closing Liquidity

Lenders don’t just underwrite earnings, they also ask what happens if the business hits a slow month after closing. Do you have enough oxygen to breathe? Your job is to make sure you won’t be so cash-strapped on day 1 that you’re immediately at risk of missing a debt payment. Post-closing liquidity is the cushion that prevents a cash crunch.

Start with working capital

Pre-LOI, you may not get enough info from the broker to size up your working capital target (peg). If possible, get 12-24 months of balance sheets and calculate working capital the right way: current assets (A/R, inventory, WIP, etc.) minus current liabilities (A/P, accrued expenses, etc.), and exclude cash since most small-business acquisitions are cash-free, debt-free.

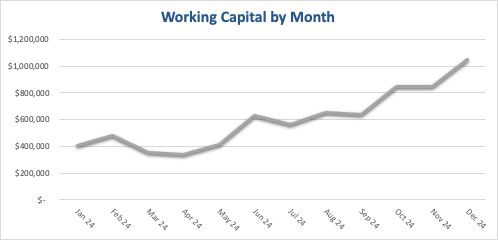

Next, plot working capital month-by-month so you can see the range and any seasonality. The chart below is a good example of why an “average” can get you in trouble. This was a B2B business that had several large enterprise customers, which would often lead to large A/R balances. Over this 12-month window, the average sits around $600K, but the year starts near $400K, dips in the spring, then stair-steps to north of $1.0M by year-end.

If you bought this business in May and funded it to ~$400K, you’d be light when the Q4 A/R builds up. This is where working capital and post-closing liquidity can go hand-in-hand: when working capital swings are large, lenders want to see a real plan for dealing with those cash swings.

In other business models (like residential HVAC), you may even see negative working capital dynamics. In that case, working capital requirements are lower and post-closing liquidity is less important (on a relative basis). But you still need to plan for cushion to deal with inevitable issues that will come up post-closing.

Building Liquidity into Your Deal

Once you know your working capital requirements, you can start figuring out how much “cushion” you need in the form of excess cash to the balance sheet at closing, your personal liquidity, and any proposed lines of credit.

Lines of Credit. Work in an SBA Express line of credit at closing. You can size it up based on the business and the expected swings in cash flow, but it’s important to get it done at closing. After closing, you may not be able to secure one.

Excess Cash to the Balance Sheet: Even if the Seller is delivering working capital, you should consider extra Day 1 cash to cover the swings. Some lenders don’t offer SBA Express lines of credit, in which case you should fund all your working capital needs and cushion right at closing as excess cash.

Personal Liquidity. Don’t empty all your savings and liquid assets to make the down payment. Keep 3-6 months of personal expenses so you’re able to sleep at night when your mortgage payment comes up.

How much is enough? Sometimes you’ll hear rules of thumb thrown around – like 5-10% of the loan amount, or three months of fixed expenses, or even some minimum dollar amount. The right number will vary based on the lender and the business you are planning to acquire.

This is part of the value of working with an SBA loan broker like SMB Loan Support – we match you to lenders based on your specific deal and circumstances. If you think through these pieces up front, you’re already showing up as the kind of buyer lenders want to lend to.

Tip #5: Address Key Risks in Your Deal Head-On

Every deal has risks. The strongest buyers don’t shy away from them. They lean in, identify the top 3-5 risks, and present a strong plan to mitigate them – both in structure and in their business plan. Here is the best way to present them:

Explain the risk in plain English, with specifics.

Explain how you are mitigating the risk.

Where possible, show the math (financial impact).

Here are two common examples of risks we’ve seen and some practical risk mitigation tactics buyers have used effectively.

Customer Concentration

Risk: Who are the customers, and what % of revenue do they represent? Who owns the relationships? Provide a list with revenue by customer and a short narrative. For example, “The top 5 customers are ~50% of revenue. Historically, the Seller was responsible for maintaining those relationships, but over the last 5 years the GM took over.”

Mitigants: You want to describe the ways your deal structure is mitigating the risk, along with any operational plans you might have to mitigate the risk.

For example, “I am working with the Seller on a customer retention plan that involves direct introductions to customers, a renewal calendar, and a dedicated account manager post-closing. The Seller is confident that these relationships will stay with the business and agreed to a contingent Seller Note. The Note will be reduced or doesn’t pay if top customers aren’t retained.”

Show the Math: Stress test what happens to revenue and earnings if you lose one or more of your top customers. Show the lender that you’ve thoughtfully considered the impact and structured the deal accordingly.

Key-Man Risk

Risk: Identify who the “indispensable” person is and what they do. Is it the Seller, a GM, or a lead technician/estimator? Do they own customer relationships, pricing/bids, vendor terms, or technical know-how that no one else has? A clean way to present it is a role map with names next to responsibilities. For example: “Today, the Seller handles enterprise sales, sets pricing, and approves major purchases; the GM runs scheduling and field ops.”

Mitigants: You want to describe both the handoff plan and how you’ll reduce single-point-of-failure risk.

For example, “We have a 90-day transition plan with the Seller that includes customer/vendor introductions, bid / estimating shadowing, and weekly knowledge-transfer meetings. The GM has signed a retention agreement with a milestone-based bonus (knowledge transfer completed, first quarter performance targets). I’m taking sales ownership and have engaged an industry advisor who will help with complex bids. The Seller has agreed to a non-compete/non-solicit and will be available on a consulting basis post-transition.”

When you show both the structure and operating risk mitigants – and you’ve backed them with numbers – you’re demonstrating you’ve thoughtfully considered the risks and protected yourself from the downside. That’s the sort of thing that gets deals across the finish line.

Conclusion

Getting under LOI is hard. Closing is harder. If you (1) underwrite cash flow like a lender, (2) use only sensible, provable addbacks, (3) make a credible case that you are the right operator, (4) show real cushion in working capital and liquidity, and (5) outline the risks with clear mitigants and math, you’ll stand out as a star to lenders. Do these five things well, and you won’t just look like a buyer who can close, you’ll look like an owner who can run the business on Day 1 and beyond.

Free pre-LOI consult. If you want a second set of eyes before you submit an LOI on a deal you’re evaluating, book a free pre-LOI consult with SMB Loan Support. We’ll pressure-test structure, addbacks, DSCR, liquidity, and lender fit. Schedule here.

Read the complete article on the SMBootcamp blog here.

Thank You!

If you know someone exploring small business ownership, we’d love it if you shared The Playbook with them, and to show our appreciation, we’ve got a few referral rewards along the way.

If you're ready to take your acquisition journey further, check out our programs below. We've designed them specifically to give you actionable, real-world frameworks and support to successfully buy and grow your own small business.

Referral Rewards

| Tier | Referrals Needed | Reward |

|---|---|---|

| Tier 1 | 3 Referrals | Access to the SMB Buyer's Acquisition Course to start your education |

| Tier 2 | 15 Referrals | DIY Essentials Course to accelerate your education ($397 for FREE) |

| Tier 3 | 30 Referrals | $500 off SMBootcamp LIVE to learn directly from experts in Tampa |

DIY Essentials

Self-paced, online core curriculum for aspiring business buyers. Perfect for those getting started or needing a flexible option.

SMBootcamp LIVE

Our flagship, 3-day in-person bootcamp covering every stage of the small business acquisition process. Hands-on and community-driven.

Accelerated Success

High-touch coaching and accountability for business buyers ready to move fast. Includes personal mentorship and priority support.

Listen to The Intentional Owner

Join me and my co-host Kaustubh Deo (@guessworkinvest on X) for The Intentional Owner—a deeply personal look at life as a small business owner. We cover how to acquire, operate, and grow businesses in ways that benefit you, your family, your team, and your community. New episodes drop every other Thursday.

If you’re passionate about small-business acquisitions and entrepreneurship, this one’s for you.

From the Blog

Dive deeper into our latest insights, playbooks, and field-tested strategies—all hosted on our site for easy reference.

Visit Our Blog