The Playbook by SMBootcamp

If you’re a self-funded searcher that gets a business under LOI, congratulations are in order. It’s easy for folks in the ETA ecosystem, whether it’s prospective investors, existing owners, or other advisors, to downplay this with a “now the real work begins!”

Fair enough. But in today’s market it’s harder than ever to get a strong deal under LOI. So I’ll be the one to say congratulations – because it’s worth taking a moment to celebrate. And after that celebratory moment, and a deep breath, you should then ask: “How do I position this deal most favorably to lenders and investors?”

That’s where we can help. At SMB Loan Support, we’ve witnessed hundreds of acquisition entrepreneurs start a search, secure a deal, and then figure out how to position that deal in the most favorable light. This article focuses on lenders, who think very differently than investors. Below are two of five ways to make lenders fall in love with your deal.

The remaining three ways, plus the full article, will be published next Wednesday, November 5.

Tip #1: Underwrite Cash Flow Like a Lender

The best buyers can not only describe what happened in a company’s financials, but why it happened. In other words, they understand the story behind the numbers.

As a buyer, it’s easy to get caught up in the multiple of earnings you are paying. You might frame a deal as “TTM EBITDA is $X, and I have the deal under LOI for 3.9x.” Sounds great.

But too often we see buyers who haven’t really examined the last three years’ results and can’t thoughtfully explain what’s driving revenue growth, gross margin expansion (or compression), and, ultimately, cash flow.

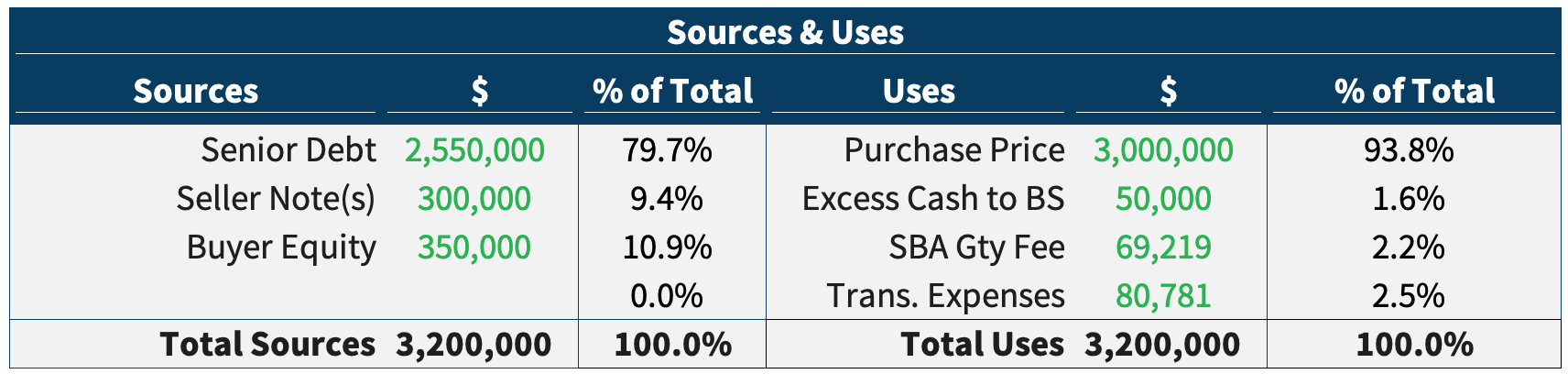

Consider a hypothetical: A buyer finds a business right in the sweet spot for a self-funded searcher: $750K EBITDA at a 4.0x multiple ($3.0M purchase price). Further assume a popular 80/10/10 structure – 80% SBA debt, 10% Seller Note, and 10% equity. The final sources and uses of funds might look something like this:

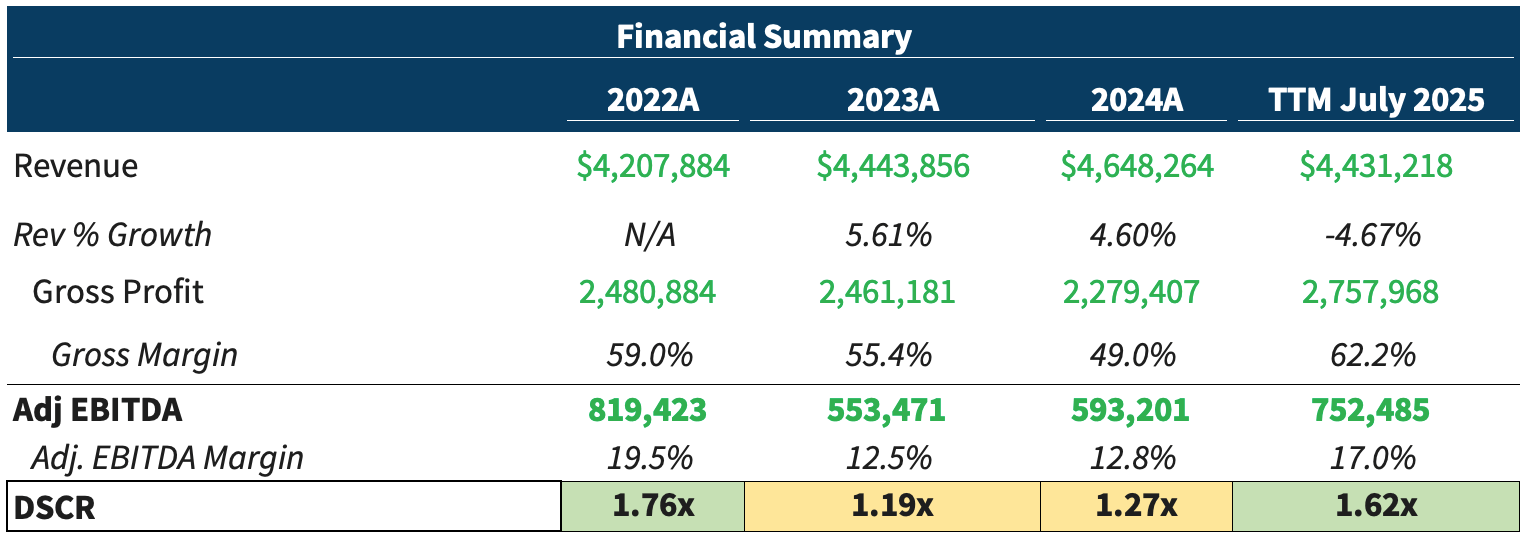

We made some assumptions on the Seller Note terms, but assume for our illustration that annual debt service is $465,000. The debt service coverage ratio (DSCR) appears healthy. $750K divided by $465K = 1.6. But now consider the last three years’ results.

This should raise some questions for our buyer. Should you expect gross margin to be 50%? Or closer to 60%? Why did margins weaken in 2023 and 2024, only to rebound in the TTM period? What’s “normal” for the industry? How does what’s normal compare to our target? How did EBITDA margin improve in 2024 despite gross margin falling to 49%?

The best buyers aren’t afraid to be the “dumbest” person in the room with the Seller and ask what’s driving the results. Sometimes there are good answers. Other times, the Seller doesn’t quite know. In either case, the numbers must back up the Seller’s story. Why are you confident the same issues won’t happen to you when you take over?

One of the most common mistakes I see first-time buyers make is failing to look at the last three years’ results – especially DSCR by year. That’s a sure-fire way to put your deal in jeopardy.

Finally, you must tie your analysis to the tax returns. Build from Net Income to adjusted EBITDA (the numerator that lenders will use in calculating DSCR):

Collect the last 3 years of tax returns

Start with net income

Add back interest, tax, depreciation, and amortization (per the tax return) to get book EBITDA.

Add back sensible, provable addbacks (such as the owner’s compensation).

Subtract pro-forma expenses (like the salary you are going to pay yourself).

The headline multiple isn’t what determines whether your deal works. A three-year, tax-return based view of EBITDA and DSCR tells you what valuation and structure actually work.

If you want help with pre-LOI structuring (including levers like Seller Note terms or two-note structure) to improve DSCR, we offer complimentary pre-LOI consultations at SMB Loan Support. Feel free to schedule a consult with us here.

Tip #2: Include Sensible, Provable Addbacks Only

If you’ve looked at brokered deals, you’ve undoubtedly seen a wide range of claimed “addbacks.” What makes SBA financing difficult is deciding whether a lender will accept those addbacks.

Here’s a question we get all the time at SMB Loan Support: can you tell me exactly what addbacks lenders will accept? Rather than give you a list that categorically declares which addbacks are a “yes” and a “no,” it’s far more helpful for you to have a framework for evaluating addbacks. Here’s the framework we find most useful:

Is this expense one-time or recurring?

Will you have this expense or a related expense post-closing?

Can it be documented and proven?

So, let’s test our framework with the most common addback: the Seller’s salary. Say there is a husband-and-wife team, where husband runs the day-to-day and pays himself $150K while wife does bookkeeping at $75K. Both are retiring. What is an acceptable addback to cash flow?

Let’s run through our three questions.

Historically, these were recurring expenses.

Post-close, you won’t pay their salaries. But you will pay yourself and you will replace bookkeeping.

If you’ll pay yourself $125K and a third-party bookkeeping firm $25K, the addback is:

Husband’s Salary: $150,000

+ Wife’s Salary: $75,000

- Buyer’s Salary $125,000

- Bookkeeping Firm $25,000

Total addback $75,000, subject to test #3.

Can you prove it? Two common ways to validate owners’ comp in SBA deals is via (1) a line-item in the tax returns for “Compensation of Officers,” or (2) a W-2 / 1099. If neither of those work, be ready with a strong explanation and documentation.

Other common addbacks (health insurance, personal vehicle expenses, retirement contributions, one-time broker prep fees) still need the framework. For example, if you add back the Seller’s health insurance, you should only add back the difference between the Seller’s cost and your post-close cost.

Harder claims include generalized “personal” travel/meals, one-time failed marketing campaigns, or costs tied to a fired employee “no longer needed.” Once you run them through the framework, you see why they’re problematic. Are they really non-recurring? You’re never going to attempt to grow the business and perhaps strike out on some marketing expenses? And can you really verify that you don’t need an employee’s role anymore to generate the historical earnings? How do you prove these things?

A few other practical tips:

Pro-Forma Rent Adjustments. If the Seller owns the real estate, rent may be below market. Confirm Day-1 rent. If the Seller paid $2,000/month and you’ll pay $5,000, subtract $36,000 from annual cash flow.

Evidence pre-LOI. In competitive deals, you may not get every document you want before going under LOI. Be clear on what you absolutely need vs. what you can be flexible with learning post-LOI.

Use a Clear Addback Schedule. List each addback with the amount, a brief description, and the rationale defending the addback so it’s easy for lenders to review.

Consider a QofE. A QofE is not required to get SBA financing. However, if your deal is especially “addback heavy,” a QofE will go a long way to giving you and your lender more confidence.

Want to make sure your deal stands out to lenders? Book a free consultation with Drew to discuss your specific scenario.

This is Part 1 of a two-part series. Stay tuned for next week’s email featuring the final three tips and a link to Drew’s full article.

Thank You!

If you know someone exploring small business ownership, we’d love it if you shared The Playbook with them, and to show our appreciation, we’ve got a few referral rewards along the way.

If you're ready to take your acquisition journey further, check out our programs below. We've designed them specifically to give you actionable, real-world frameworks and support to successfully buy and grow your own small business.

Referral Rewards

| Tier | Referrals Needed | Reward |

|---|---|---|

| Tier 1 | 3 Referrals | Access to the SMB Buyer's Acquisition Course to start your education |

| Tier 2 | 15 Referrals | DIY Essentials Course to accelerate your education ($397 for FREE) |

| Tier 3 | 30 Referrals | $500 off SMBootcamp LIVE to learn directly from experts in Tampa |

DIY Essentials

Self-paced, online core curriculum for aspiring business buyers. Perfect for those getting started or needing a flexible option.

SMBootcamp LIVE

Our flagship, 3-day in-person bootcamp covering every stage of the small business acquisition process. Hands-on and community-driven.

Accelerated Success

High-touch coaching and accountability for business buyers ready to move fast. Includes personal mentorship and priority support.

Listen to The Intentional Owner

Join me and my co-host Kaustubh Deo (@guessworkinvest on X) for The Intentional Owner—a deeply personal look at life as a small business owner. We cover how to acquire, operate, and grow businesses in ways that benefit you, your family, your team, and your community. New episodes drop every other Thursday.

If you’re passionate about small-business acquisitions and entrepreneurship, this one’s for you.

From the Blog

Dive deeper into our latest insights, playbooks, and field-tested strategies—all hosted on our site for easy reference.

Visit Our Blog