The Playbook by SMBootcamp

This week, we’re tackling a critical question for every acquisition entrepreneur: how do you maximize your odds of ending up on the right side of the outcome curve? In ETA, too some buyers get stuck in the “treading water” scenario with businesses that cover debt but never break through to real growth. The alternative is cresting the hill into sustainable profitability, where compounding takes over and outcomes become exceptional.

To explore this, we teamed up with SMB investor and operator Grant Hensel, who recently raised an $11M+ ETA fund and writes This Week in ETA, a great roundup of industry insights. Together, we break down the four fatal flaws we’ve seen across hundreds of deals that can kill your shot at a right-side outcome and how to avoid them.

We’re also excited to announce that enrollment for our October and December LIVE cohorts is open. These cohorts offer a hands-on opportunity to master small business acquisitions the right way. Seats are limited: secure your spot today!

About Grant Hensel

Grant Hensel is a serial entrepreneur, investor, and SMB operator. He is the Founder & Chairman of Nonprofit Megaphone, serving nearly 800 clients, and previously acquired Lexigate, an SEO agency, through a self-funded search. Having started nine other businesses (with wins and some misses), Grant now invests in searchers via Entrepreneurial Capital and writes This Week in ETA, a leading newsletter for the ETA community. He earned his MBA with Honors from the University of Chicago Booth School of Business.

Table of Contents

Introduction

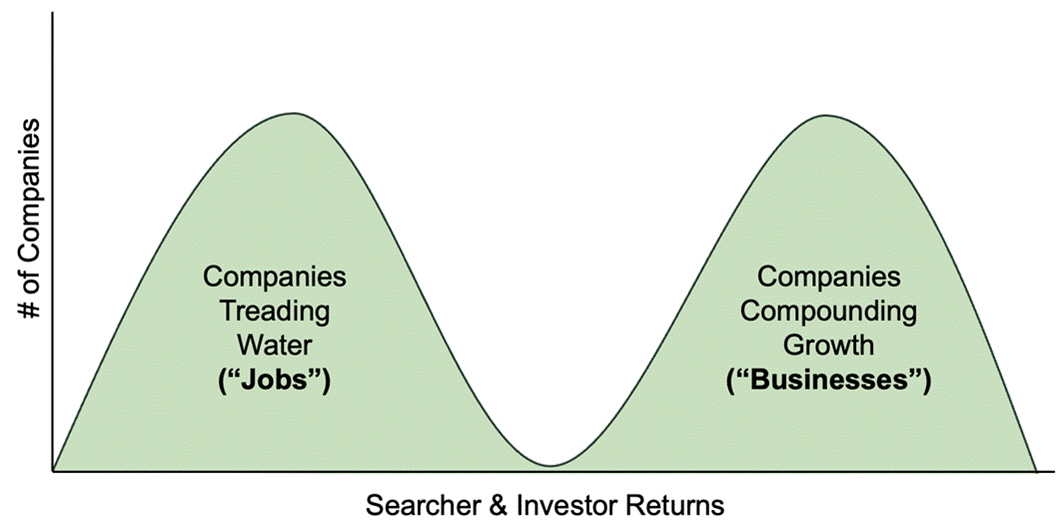

“Self-funded search deals don’t follow a power law like venture capital, or even a normal bell curve. You have two groups of companies: those that tread water and do ok, and those that achieve meaningful growth and do very well.”

Self-funded, SBA-financed deals are relatively new to the marketplace—consider LBO-style private equity deals have been around for decades as have traditional Search funds. Venture capital has been around for centuries (see: Dutch East India Company in the early 1600s). Thus, the amount of aggregate returns data are fairly limited. To give a perspective into the returns of investors, we’ve tapped some help from Grant Hensel of Entrepreneurial Capital (he recently raised a $11M+ fund to invest in SBA deals). Between SMBootcamp and Entrepreneurial Capital, the deal flow is quite strong with hundreds of investment opportunities screened per year.

While there isn’t a ton of data readily available on returns, there is a lot of history and precedent for how to evaluate transactions and best-position yourself on the right side of the theoretical curve. Before you consider ETA as a potential path, we’d urge you to understand the risk and reward profile of owning a small business, while simultaneously arming yourself with an investment-grade analytical skillset.

Two Very Different ETA Outcomes

When talking to serial investors in ETA (including what we’ve seen), it is believed there are two “peaks” in the curve (like you see below). This is quite different from the bell-curve that you see in private equity and the power-law concept you see in venture capital. The concept of power-law is best illustrated with the recent IPO of Figma, which saw an initial VC investor return 90x on its invested capital. This is clearly not what happens for us acquisition entrepreneurs. What we believe to be true in SBA deals is that there are two curves—one with businesses that are “treading water” and others that are able to crest the cash-flow hump, leading to compounding growth.

Depending on the size of the business, the “treading water” outcome could ultimately end up being a life-changing opportunity, specifically for larger businesses of $1m EBITDA+ where you’ll generate ~$1m of free cash flow (minus debt service) and have a multi-million dollar exit on the horizon. But if you acquire a $300-$400k SDE business, that outcome could be far less attractive. Taking on personally guaranteed debt for ~$200-300k of free cash flow with around a million-dollar exit might not be worth the 10 years of risk, stress, and effort relative to other career opportunities. It isn’t too dissimilar from the outcome of you working a W2 job for a decade—and in some cases it may be far worse. From both the Acquisition Entrepreneur and investor lens, we obviously want to be on the other peak of the curve.

With the second peak, the companies who grow stronger over the years, the acquisition entrepreneur’s ownership is generally a great outcome regardless of career alternatives. This is where you see business owners who can take vacations without a shipwreck. The owners who wake up every day excited about the opportunity in front of them. This is where you want to be.

So what’s the best way to position yourself to achieve this goal?

4 Ways to Position Yourself on the Right Side of the Curve

“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.” – Warren Buffett

The most prolific investor of our time, Warren Buffett, famously said this in his 1989 letter to shareholders. He’s referring to the inability of even the most extraordinary management teams to “fix” a bad business. Frankly, this is reality for some acquisition entrepreneurs—even the brightest and most enthusiastic can falter when they purchase a “bad” or “tough” business. This is especially true at the leverage levels that we use for acquisitions.

To avoid this outcome, it is crucial to evaluate four key criteria when evaluating opportunities. In an ideal world, each business will have all four traits—it’s a great indicator of success. The fewer of these traits you have, the more likely it is that the acquisition will be in that first peak (or worse).

#1: Low Customer Concentration

In Grant’s case, he has personally experienced the pain of losing major customers representing 20%+ of revenue, leading to extremely painful revenue and profitability losses. Losing major customer isn’t just missing invoices and a weaker QuickBooks output—it’s a blow to your team. Major customer losses result in major cost-cutting measures, including extremely draining and difficult layoffs. Certainly not a place you want to be.

The loss of major customers is a stressor that business owners especially do not want to encounter while under a serious obligation to the SBA lender. The gold-standard lending ratio for SBA lenders is debt service coverage ratio—the ratio of cash flow to debt obligations. Losing a major customer severely limits your ability to meet that obligation. When you only have a few thousand dollars in the bank account and payment to the bank due on the first of the month, you probably won’t be sleeping at night. In the worst-case scenario, a default can lead to personal bankruptcy.

Even in the upside case, major customers are suboptimal. In many B2B businesses, including ones that we’ve invested in at SMBootcamp, these can be a major source of cash-flow strain despite the growth potential. When a big purchase order comes in for a new or existing major customer, there are capital expenditures and working capital investments needed to fulfill such a large order (more on that below). While these are generally a net positive for the business, customer concentration can still have negative consequences even on the upside.

This isn’t to say that customer concentration can be avoided in every transaction, but it is something to seriously consider during diligence.

Entrepreneurial Capital won’t even consider transactions where the loss of the top 1-2 customers would lead to insolvency. And it might be a prudent approach to enact similar criteria for your search.

#2: Low CapEx and Working Capital Intensity

While EBITDA is the gold-standard metric in M&A transactions, it isn’t a perfect measure of cash flow. Warren Buffett is often credited with the quote, “Does Management think the tooth fairy pays for capital expenditures?”, and he has a point. Depreciation is a real expense—those depreciating assets have to be replaced constantly in order to deliver service at the same historical levels. Many businesses can show healthy EBITDA, but when they’re forced to reinvest much of their profitability into working capital and capital equipment, that excess cash flow can evaporate, leading to treading water scenarios.

Businesses with meaningful capital equipment are exposed to “shocks” of various sizes depending on the lifecycle of equipment and the need for more equipment to grow. This can lead to a step-wise function where operators must choose between investing in growth or maintaining profitability. In the worst-case scenario, you have to replace an expensive piece of equipment to maintain normal function when you may or may not have the immediate cash to do so.

This is similarly true with working capital intensity. The more money you have “tied up” in inventory, accounts receivable, etc., the less free cash flow you can compound into growth to get on the right side of the curve.

When taking on new customers, new jobs, new projects, you must consider the cost associated with that growth. At a high level, these major wins often require additional capital expenditure or working capital investments, forcing a painful decision between long-term growth or short-term profitability. A precarious situation to be in when evaluating the feasibility of the operator’s growth plans for the business. You could very easily end up in the treading water scenario despite working extremely hard not to be.

#3: Low Cyclicality (Providing a Non-Discretionary Product/Service)

Nobody has a crystal ball that can predict the next recession, but the SBA 7a loan has a 10-year term. It’s fairly likely that you’ll see a major economic shock sometime in any given decade (hopefully later in the 10-year period than earlier).

Just like turkeys on a farm leading up to Thanksgiving, highly cyclical businesses may experience year after year of growing revenue and profits, becoming more and more confident in their “track record” with each passing year… until the music stops.

While past performance is something of an indicator of future performance, it isn’t a perfect corollary. Homebuilders crush year after year in booms and almost go bankrupt in the down cycle. Thus, analyzing the true cyclicality and non-discretionary nature of the business becomes paramount. Taking a first-principles approach by distilling the business’s demand drivers into their simplest components is the key here. The homebuilder example is relatively easy—the demand driver is homes being built. But it may be a bit more difficult to pin down for other businesses. For example, take the home services space where everyone will sell you the maintenance plan and various on-site up-sells (that may or may not be non-discretionary). How likely do you think it is that the maintenance plans and $10k+ new replacement installs for your garage door, water heater, and HVAC unit will hold up in a downturn? Tough to truly nail down, but we can say with a degree of certainty that the AC maintenance plan and new-unit upsell is less likely to hold up than true break-fix repairs.

It's a safe bet to consider the true cyclicality of your business as it relates to your ability to service debt and continually compound excess free cash flow into growth. Deeply understand the drivers of your business, lest you end up on the wrong side of the curve.

#4: History of Stable Profitability

A stable history of profitability is not a guarantee that profitability will continue, but the Lindy Effect is a valuable heuristic: Things that have survived a long time are more likely to persist.

For businesses, a track record of two decades of fairly stable profitability (including through shocks like the 2008 Great Recession) is extremely compelling for both the acquisition entrepreneur and investors.

Businesses that are only a few years old, despite showing great promise, are untested across a range of economic climates and cycles. Ultimately, there are so many variables leading to business performance that it’s extremely difficult to tease out if they will persist. We’ve seen this quite a bit with Florida roofing contractors. Young roofing businesses will pop up with the sole purpose of soaking up demand in hurricane-ridden years. They are extremely profitable and are easily SBA-sized within 12-36 months. Despite this rapid growth, they are often very poor SBA-financed targets without a history of generated demand outside of recent circumstances (i.e. hurricanes). Is this a business that shows potential to continually compound growth into a “right-side” outcome?

A history of profitability can be considered both the weakest and strongest of the four filtering criteria we’ve mentioned:

● The weakest, because circumstances change. A decades-old translation services business has a much more uncertain fate today, given advances in AI tools.

● The strongest, because if a company has grown and reliably made distributions to owners for many years, it has demonstrated resilience in reality, which is far more intensive than any possible spreadsheet stress-testing exercise.

In summary, a history of profitability is a great sign, but it is not a perfect metric. Each business must be evaluated in combination with the criteria above (among others) to determine whether it is likely to see the compounding growth that leads the exceptional outcomes on the right side of the curve.

Final Thoughts

ETA is not a road to be undertaken lightly. After seeing hundreds acquisition entrepreneurs acquire small businesses, it is an extraordinary path for many that have acquired businesses, but others are merely treading water for the duration of their SBA loan.

As programmers say, “many eyes make bugs shallow,” and there’s almost no amount of diligence that isn’t worthwhile when making as momentous a decision as buying a business. The more of the four key criteria your business has, the more likely you are to end up on the “right side” of the curve.

If you’re an acquisition entrepreneur under LOI looking for investors, Grant and Entrepreneurial Capital are here to help. They’re more than happy to share reflections on investment opportunities.

If you’re an acquisition entrepreneur looking for guidance, we’d highly recommend attending SMBootcamp to develop your investment skillset.

Thank You!

If you know someone exploring small business ownership, we’d love if you shared The Playbook with them and to show our appreciation, we’ve got a few referral rewards along the way.

If you're ready to take your acquisition journey further, check out our programs below. We've designed them specifically to give you actionable, real-world frameworks and support to successfully buy and grow your own small business.

Referral Rewards

| Tier | Referrals Needed | Reward |

|---|---|---|

| Tier 1 | 3 Referrals | Access to the SMB Buyer's Acquisition Course to start your education |

| Tier 2 | 15 Referrals | DIY Essentials Course to accelerate your education ($397 for FREE) |

| Tier 3 | 30 Referrals | $500 off SMBootcamp LIVE to learn directly from experts in Tampa |

DIY Essentials

Self-paced, online core curriculum for aspiring business buyers. Perfect for those getting started or needing a flexible option.

SMBootcamp LIVE

Our flagship, 3-day in-person bootcamp covering every stage of the small business acquisition process. Hands-on and community-driven.

Accelerated Success

High-touch coaching and accountability for business buyers ready to move fast. Includes personal mentorship and priority support.

Listen to The Intentional Owner

Join me and my co-host Kaustubh Deo (@guessworkinvest on X) for The Intentional Owner—a deeply personal look at life as a small business owner. We cover how to acquire, operate, and grow businesses in ways that benefit you, your family, your team, and your community. New episodes drop every other Thursday.

If you’re passionate about small-business acquisitions and entrepreneurship, this one’s for you.

From the Blog

Dive deeper into our latest insights, playbooks, and field-tested strategies—all hosted on our site for easy reference.

Visit Our Blog